One of the most overlooked steps when beginning the process of importing a product is to understand Incoterms. They play a crucial role as the define who pays for what and sometimes more importantly who is liable for the cargo at individual points during transit.

Incoterms are recognised all over the world, and any supplier that has been dealing with international shipments before will know what you are talking about.

Your supplier may well suggest an incoterm, however, it is you as the importer that should nominate which one you want to use. If the supplier does not agree with what you suggest, this should firstly set the alarm bells ringing and I would consider using another supplier if possible or at least negotiate the term to be used. By no means accept what terms the supplier offers without looking at all potential costs involved as it could turn into a costly experience.

Incoterms 2010

There are four main ‘groups’ of Incoterms. E, F, C & D.

Group E = the supplier’s responsibility ends when the goods are ready to leave their premises.

Group F = the main cost of shipping is not paid by the supplier.

Group C = the supplier pays for the main cost of shipping.

Group D = the supplier's responsibility ends at a specified point, and they deal with who will pay pier, docking and clearance charges.

Group E

EXW (Ex Works) – This Incoterm basically means you will pay the supplier only for the cost of the goods – everything else is down to you to organise. The supplier will make goods available at their premises for you to arrange collection. Your liability commences once the goods are collected.

Group F

FOB (Free On Board) – The Supplier pays to get goods to named port of shipment (or warehouse). They will cover any charges up to ‘ship's rail’ (goods being loaded on Vessel or into Groupage container), after this point the liability for the goods is passed to you.

FCA (Free Carrier) – Very much the same as FOB above but much less commonly used. Importer pays loading charges/terminal charges.

FAS (Free alongside Ship) – Again very similar to FOB above also less commonly used. Importer pays loading charges.

Group C

CFR (Cost and Freight) – All charges including freight is paid by the Supplier up to named port of destination. The risk is transferred to you the importer once goods pass the ship’s rail at port of loading. All costs on arrival UK are your responsibility.

CIF (Cost Insurance and Freight) – As per CFR but Supplier arranges insurance of the goods.

CPT (Carriage Paid To) – As per CFR but much less commonly used.

CIP (Carriage and Insurance Paid To) – As per CIF but much less commonly used.

Group D

DAT (Delivered At Terminal) – Supplier is responsible for all cost up to UK ‘Terminal’ (Within the Port of arrival). Risk is switched to you upon unloading at the Terminal.

DAP (Delivered At Place) – Supplier is responsible for all costs up to final delivery point (named place of destination), apart from Destination Customs Clearance and carries all risk up to the point that goods are ready for unloading.

DDP (Delivered Duty Paid) – Supplier is responsible for all costs except import VAT and carries all risk up to the point that goods are ready for unloading.

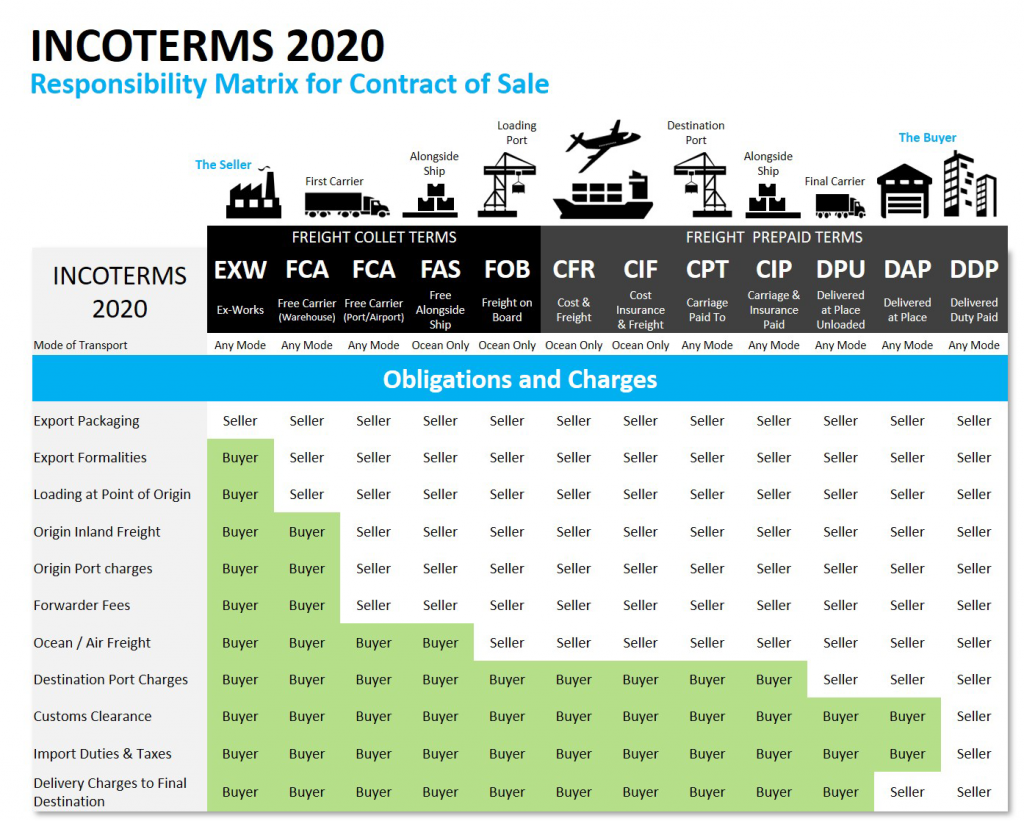

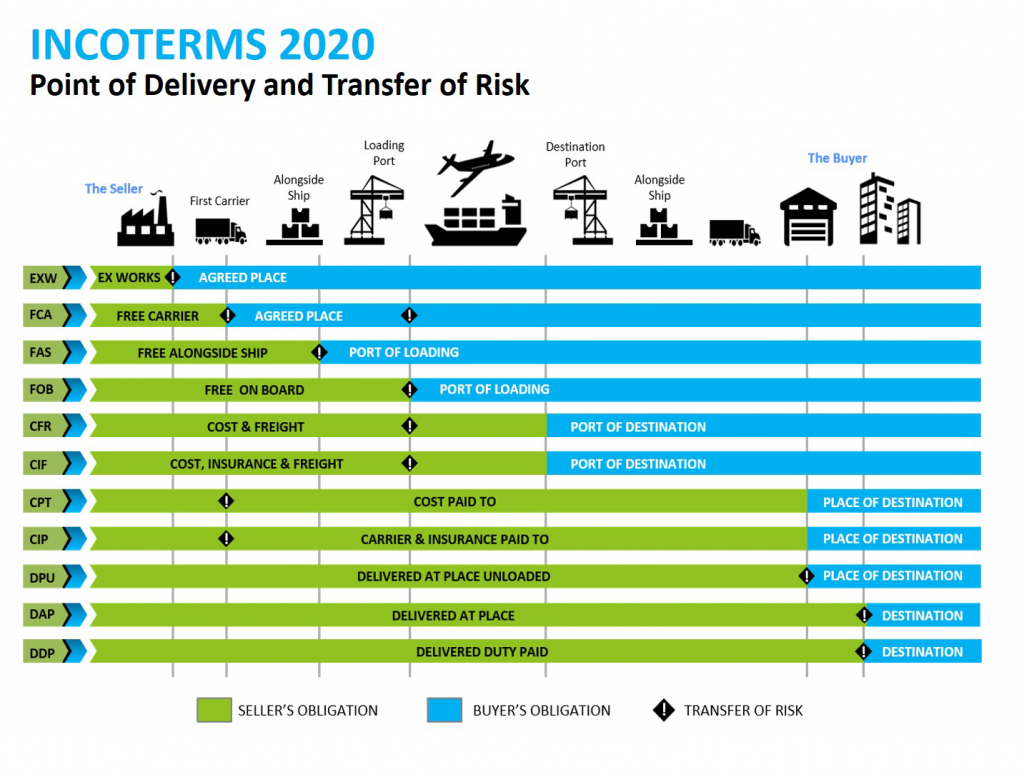

The below chart gives an easy visual guide to which party is responsible for what under various incoterm options.

Incoterms Examples

An incoterm comprises of two components: a three letter code and a city name.

Without an incoterm, there is no definition to your responsibility in transporting your cargo.

When importing from China, mostly all reputable suppliers will provide a price based on an incoterm and a city. Below is an example when purchasing goods from a supplier in Shanghai.

FOB Shanghai Port

- You book shipping space through your freight forwarder loading at Shanghai Port

- Your supplier handles the inland delivery to Shanghai Port

- Your supplier handles Customs export declaration

- Your supplier pays all cost at the Shanghai Port until departure

- You pay all cost thereafter from when cargo leaves to delivery at destination.

Charges you will pay are sea freight charges, destination port charges, Customs, VAT, tariff and duties, inland transportation to your door or warehouse.

CIF New York Port

- Your supplier books shipping space from their local port

- Your supplier handles the inland delivery to the departure port

- Your supplier handles customs export declaration

- Your supplier pays for all costs until cargo arrives at New York port

- You pay all cost thereafter from when the cargo arrives at New York port.

You pay destination port charges, Customs, VAT, tariff and duties, plus any inland transport to your door.

Additional information

‘Incoterms’ has become a standard term in global trade. It’s actually been copyrighted by the International Chamber of Commerce (ICC). The first issued Inco Terms was in 1936. Since then there have been 5 revisions with the latest being Incoterms 2010.

These Incoterms are recognised by The United Nations Commission on International Trade Law (UNICTRAL) as being the global definitive for transportation; and they are accessible in nearly every language through ICC.

Please note that the different entities involved in a shipping transaction may decide between themselves to use a another version, Incoterms 2000 the most likely candidate. By far the bulk of international trade, however, is being done using Incoterms 2010..

Old Incoterms - not in Incoterms 2010

As mentioned above, the parties may decide to use previous versions of the terms, and the ones detailed below are no longer found in the 2010 version but may still be encountered.

DAF – Delivered at Frontier (named place of delivery)

For rail and road shipments. Supplier pays for transport to the country frontier. Buyer arranges for customs clearance and transport from frontier to his site. Risk transfers to the buyer at the frontier.

DES – Delivered Ex Ship (named port of delivery)

Typically come across this term with bulk commodity shipments, where the seller charters or owns the vessel. Unlike CFR and CIF, seller assumes not just cost, but all risk until arrival of the ship at the delivery port. Buyer pays to unload plus customs duties, taxes, etc.

DEQ – Delivered Ex Quay (named port of delivery)

Basically the same as DES, apart from risk transfers only when goods are unloaded at the destination.

DDU – Delivered Duty Unpaid (named place of destination)

Supplier arranges transport to the ultimate destination in the contract. The goods are not cleared for import or unloaded. The buyer is responsible for all costs and risks beyond this point. Any variation must be clearly worded in the contract

Further Information

International Chamber of Commerce (ICC)

Wikipedia Article on Incoterms