The container shipping market continues to breathe a sigh of relief as the deterioration in rates from Asia-Europe and Asia-United States finally came to a halt. Annual Asia/North Europe contracts were signed for $1,600-2,000 per 40' container, enabling shipping companies to keep their heads above water in terms of profitability, without much room to deal with any unexpected developments.

The recovery of the shipping market will likely be slower than expected due to the sluggish distribution of reductions in the price of energy and basic foodstuffs. Despite the growth in global geopolitical tensions, the markets have stabilised. However, the tensions could have a more devastating effect on world trade than the pandemic. In such a scenario, diversifying supply sources and partially resorting to near-shoring is more pertinent than ever.

As always, for the best current spot pricing, just click the below button or hit reply to this message.

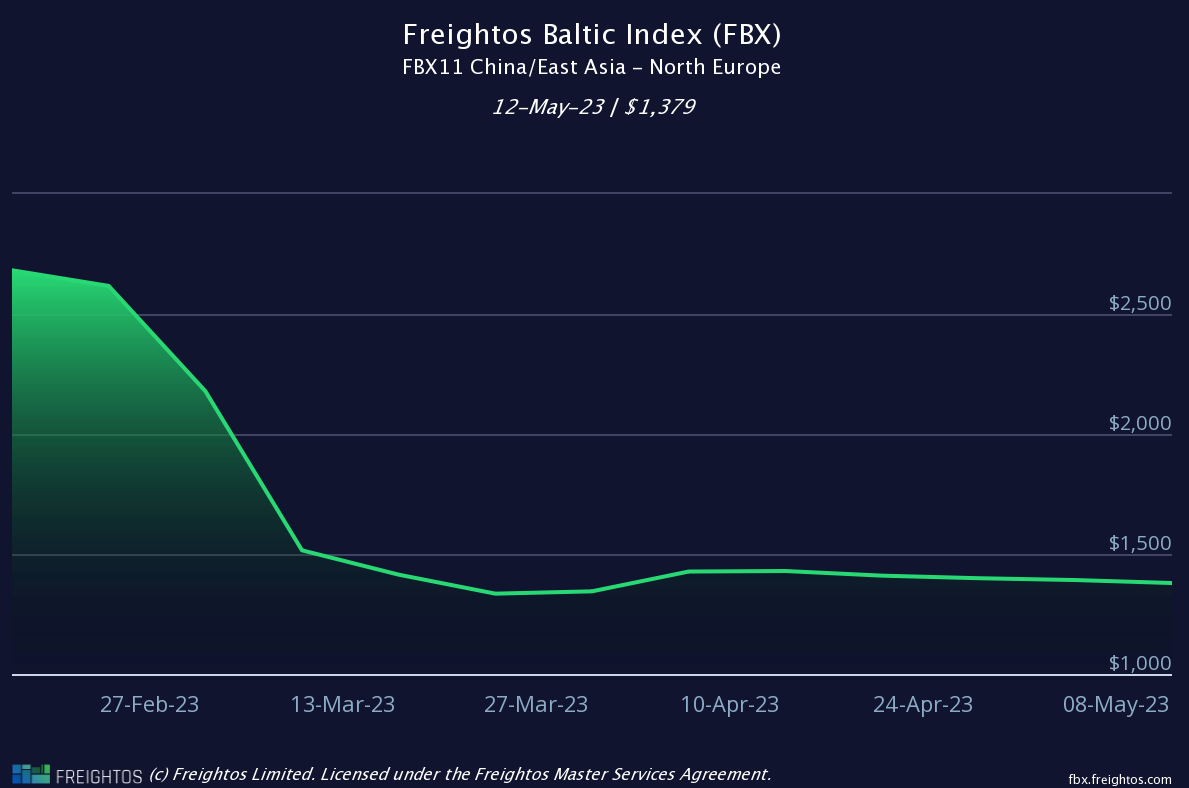

Below indices are always lagging on the actual achievable rates, but provide a good record & visual of the situation.

XSI® - C

Report a figure of $1,380 per 40’ container (FEU) dated 09/05/23 (down 0.93% WoW)

FBX

Report a figure of $1,392 per 40’ container (FEU) dated 12/05/23 (down 1% WoW)

News

Tweets

Yeah that’s a hard pass for me bud 😂😂😂😂 https://t.co/0DbUzNsvyY

— Joe Spisak | Fulfill.com (@joespeezy) May 11, 2023

Amid a supply chain crisis, delays can cause customer satisfaction to plummet. Organizations must use transparency, personalization, and empathy to enhance customer service efforts.

— Digital SMEs Goals (@SmesGoals) May 11, 2023

Source @TechTarget Link https://t.co/2MGzlGRXTP rt @antgrasso #supplychain #CPO #CXO pic.twitter.com/yWj8IzSxIC

Germany’s Hapag-Lloyd, the world’s fifth-largest shipping line, posted better-than-expected results for the first quarter of 2023, with freight rates averaging $3,998 per forty-foot equivalent unit, 85% above pre-COVID levels.https://t.co/ivyprFnNxz

— American Shipper (@AmericanShipper) May 11, 2023