Reduce your customs costs

Customs Cost Burden

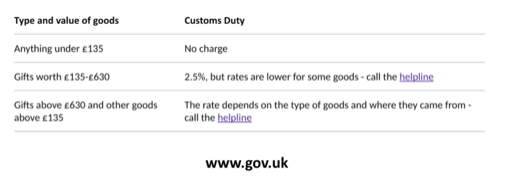

How much do customs costs represent? Is it worthwhile to take a look at different ways to reduce them? Certainly, it will depend on the product and country. When importing, you may have to pay VAT, Customs Duty or Excise Duty on goods sent from outside the European Union (EU) before you can collect them.

In certain cases, you don’t pay VAT or Customs Duty. For instance, when your personal belongings are sent back to you.

You must also check that the sender:

- pays Excise Duty on any alcohol or tobacco sent from the EU

- declares goods correctly if they’re sent from outside the EU

In the UK, you will be charged Customs Duty on gifts and other goods sent from outside the EU considering their value. This includes anything new or used that you:

- buy online

- buy abroad and send back to the UK

- receive as a gift

The value includes:

- the price paid for the goods

- postage, packaging and insurance

Duty rates vary from 0-217% with an average rate of 4% for imports into the European Union. We definitely need to carefully analyze them.

Classification & Reclassification of your Products

Classification

When entering the UK market, goods are highly likely subject to Customs Duty. The EU contemplates the same rates to ensure a ‘fair market’. Nonetheless, there can be a significant difference in terms of duty rates from product to product. As mentioned above, they range from 0% until 217%.

How do I know which duty rate is applicable to my product? The first step should be for you to check the tariff classification. This will tell you what tariff code should be used to import your products. This code – also called the HS code - consists of ten digits in the EU and worldwide they only vary slightly, usually with the first six digits being the same.

You can check the tariffs online by visiting https://www.gov.uk/trade-tariff/sections. You may also call Revenue and Customs for assistance in the tariff classification for your goods. Please keep in mind this is not legally binding but generally will be very accurate depending on a clear description of the goods in question. It is important to note that both methods above are somewhat subjective.

If you are considering high value imports or you are looking to import on a regular basis, a BTI ruling is recommendable. A BTI ruling is a written, legally binding confirmation of your tariff code and removes any subjectivity. It also eliminates the risk of being asked for post clearance payment of underpaid Duty for a period of up to three years, if you have used a lower duty rate than the goods should have been liable for. The BTI is an important protection against this.

Reclassification/ Tariff Engineering

To reclassify your products to commodity codes with a lower or nil duty rates can lead to significant savings for your business by reducing (legally) your custom duties.

While it is true that each product you import should be classified to only one specific commodity code in the customs tariff, such a tariff includes over 16,000 codes. Considering this, to identify the correct tariff code is challenging. There are many gray areas and the line between one classification and another is sometime very fine. Below are some examples:

- Wet noodles (in water) attract a lower duty rate than dried noodles;

- Dolls based on mythical creatures attract a lower duty rate than dolls representing humans.

Indeed, a slight modification of your product specification - known as tariff engineering - can sometimes reclassify your goods into another commodity code and therefore tariff by improving your profitability.

Stripping Down Your Products

Let’s work under the assumption that your imports are correctly classified to the code attracting the lowest rate. You may still have an opportunity to further reduce your costs by stripping down imports into kits to accomplish a more favorable net duty rate.

For example, a stereo turntable is subject to duty at 2% but the stylus, which is a high value item, could be imported free of duty. By separating the stylus away from the turntable and hence presenting the two items separately would reduce any import costs.

When estimating savings we need to consider the Total Cost of Ownership (TCO). This means all the factors in a comprehensive approach. For instance, these savings potentially achieved by stripping down the stylus from the turntable have to be weighed against the costs of fixing the stylus back on to the turntable after import, considering the corresponding labor cost. This cost greatly differs by country. It is not the same the cost of labor in Asia than in the EU.

Another example is bicycles. Bicycles carry a basic Duty rate of 14%. Stripping these down to major parts being shipped separately would attract a duty rate of 4.7%. The same considerations apply in relation to TCO.

Bundling Your Products

In some cases, instead of shipping the items separately, you may have an opportunity to reduce your costs by taking advantage of bundling. This consists of presenting various components at the same time in kit form provided the finished item attracts a lower rate of duty than the individual components.

For instance, most parts used to make digging machines are subject to duty. Nonetheless, the finished digger could be imported free of duty. Presenting a kit of parts could result in the digger parts being classified as the finished digger and therefore realize material duty savings. The legal classification rules and a specific duty relief particularly support this approach.

Taking advantage of Trade Agreements

The many Trade Agreements that the EU has entered with hundreds of countries offer the advantage of qualifying imports to attract reduced or nil rates of duty.

In order to be a qualifying import, there are various requirements to be met before you can benefit from Trade Agreements. Clearly, it is critical that your goods must 'originate' in the beneficiary country. As evidence of the origin, there are certain certificates such as GSP’s and EUR1’s. These certificates are issued by your supplier and you must provide your freight forwarder with the original to claim preference. You may check with the HMRC advice line in advance in relation to what certificates would give Duty preference to what products from what countries. You will be asked for the tariff code and a specific country of origin. Your freight forwarder is another option to advice on this matter.

Identifying whether your product meets the origin rule is often complex and leads to error as these rules depend on the classification of your product.

Due to this, many businesses decided not to use this type of planning since in the past the authorities frequently challenged the applicability of Trade Agreements. Even when the duty preference was applicable, authorities attempted to recover duty savings going back three years. However, there are now specific steps you can take to lock in any benefits you obtain.

It is highly recommendable that you check your imports on a regular basis. If the supporting documentation is not available at the time of import, you may pay the duty at full rate. However, if you pinpoint these errors you can still recover the duties if claims are made within 10 months of import.

Deducting some intangible from the customs value

As we have seen, customs duties are generally a percentage of the value of your imported goods. The value includes the purchase price, packaging, freight and insurance, among other elements.

Conversely, you can elect to deduct certain elements, such as buying commissions, finance charges, settlement discounts etc., from your purchase price to reduce your duty costs.

You will need to review your supplier contracts or agreements to ensure you are taking full advantage of these options and they are clearly documented. If these deductible items exist in practice but are not shown separately in your agreements then you should consider possible changes going forward to reduce customs costs. This doesn’t mean necessarily affecting the amounts you pay your suppliers. These deductions can be applied retroactively due to a recent European Court of Justice Decision. The retroactive period can extend up to three years back.

Prior Sale/ Onward Sale

Customs duties are usually calculated as a percentage of the price from the exporter to the importer (£300) plus other factors such as freight & insurance. Prior Sales planning allows the importer to use an earlier sale – when you buy goods that are subject to a chain of sales before import (e.g. either the £100 or £200) as the basis for the duty calculation. By doing so, you strip out any subsequent mark-ups from a charge for duty.

This planning requires you prove a number of conditions apply, including having access to information including the earlier sales price which usually limits this type of planning to related party movements.

For example, if you are buying a product from a UK company which you know they are importing from outside the EU and they are willing to provide you with the original commercial invoice from their supplier without their own markup, you are able to use this to base Duty/VAT payments. Certainly, in most cases they will be reluctant to provide such information, as you will know both what they paid for the goods and who the supplier is. However, this may be applicable to scenarios where sister companies are involved.

Duty Relief on Export/ Inward Processing Relief

Customs regulations provide various ways of reliefs to reduce the landed costs or total cost of ownership (TCO) of the informed importer.

Inward Processing Relief (IPR) allows you to claim duty relief on raw materials, components and goods imported for processing which are subsequently sold outside to the European Union. Processing in this context could be a simple a process as repacking goods or sticking a label on the pallet, right through to complex manufacturing such as full reworking or fitting.

You will need to obtain authorization to benefit from IPR and, in some circumstances, you may be able to get retrospective approval going back one year. At the same time, you will also be assuming additional obligations. Despite this, if you invest properly in setting up the procedure, these requirements can be streamlined. It is key to bear in mind that if you fail to meet any of the conditions of any duty relief then you may lose any benefit with retrospective effect going back up to three years.

Re-importing Products/Returned Products Relief

Once you export your goods outside the EU they no longer bear their EU status and hence, they will be subject to duty or VAT on re-importation. Nonetheless, Outward Processing Relief (OPR) allows you to claim total or partial relief on goods you send outside of the European Union to be processed, repaired or replaced. Like IPR (above) you will need to obtain an authorization to benefit from OPR and have adequate evidence of the original export.

Working with 3PL’s

To select the right 3PL is a vital piece. Just think that your costs are increasing for every minute that your goods are at the port. Undoubtedly, time is money and time at customs means big money.

Considering the above, I cannot emphasize well enough how important is scheduling when shipment will arrive and when it is going to leave the port. Analysis such as the cost of different ports and multimodal are highly recommendable.

Cash Flow Planning

Considering that you have reduced your costs through reducing the duty rate, customs value and applied all appropriate reliefs. What’s next to reduce (legally) my customs costs?

Cash-flow planning can give you an edge. By default, your imports are subject to customs duty and import VAT at time of arrival into the European Union. If you are a regular importer then you probably pay your duty and import VAT on the 15th of the following month using a deferment account.

When you implement customs warehousing, you can obtain further cash-flow advantages by deferring the customs and import VAT point until call off from the warehouse and delaying payment of your customs duty and import VAT until the 15th day of the month following call off. The warehouse can be a physical building or virtual system, as with drop shipping.

Transfer Pricing

Transfer pricing is a matter that should not be taken lightly. A scenario where transfer pricing takes place is with intercompany sales. If transfer pricing is not properly considered, we can have tax issues along with customs issues. This implies much higher costs that can be avoided.

Free Trade Zones

It is helpful to conduct an analysis on the benefits and costs of free trade zones, in particular, when we do not plan to utilize all the goods in a certain shipment.

From large manufacturers to individuals, any size importer or exporter can benefit from a foreign-trade zone (FTZ). However, many companies are unaware of the sizeable cost savings and other benefits they can achieve by taking advantage of an FTZ program. Utilizing an FTZ can significantly reduce costs from customs duties, taxes and tariffs; improve global market competitiveness; and minimize bureaucratic regulations. Below are some benefits of using an FTZ.

- Deferral, reduction, or elimination of certain duties. Companies can bring goods into the FTZ without duties or most fees, including exemption from inventory tax.

- Duty exemption on re-exports. Since an FTZ is considered outside the commerce of the UK, a company importing components or raw material into the FTZ does not pay Customs duty until the actual import takes place. If the good is exported from the FTZ, no Customs duty is due.

- Duty elimination on waste, scrap, and yield loss. Since a manufacturer operating in an FTZ does not pay duties on imports until its goods leave the FTZ and enter the UK, it essentially is paying for the duties on the raw materials after they have been processed. Thus, duties owed do not include manufacturing by products, such as waste, reducing the amount of goods taxed.

- Weekly entry savings. Instead of filing an entry every time a shipment enters the country, an importer operating in an FTZ only needs to file one Customs entry a week, reducing paperwork and costs associated with entry filings. Weekly entries also save on customs brokerage fees.

- Enhanced compliance, inventory tracking, and quality control. FTZs allow companies to more closely track their inventory. By bringing goods into an FTZ warehouse that you control, you can identify and classify goods at the warehouse instead of at the port at a Customs control location.

- Indefinite storage. A company can hold its goods indefinitely in an FTZ until a port opens up, or if there are quotas on a good, until they can be entered into the UK territory.

- Waived customs duties on zone-to-zone transfers. FTZs can be used to manage transshipping operations, saving money on manufacturing processing fees. While most companies are focused on using FTZs for exports, FTZs can also be used to take advantage of crossdocking and transferring goods from one FTZ to another without paying Customs duties.

Final Thoughts

As we have seen, there are many ways to reduce (legally) customs costs. We need to be aware of the options available and take advantage of them. Let’s be informed, take wise decisions and avoid incurring in unnecessary customs costs. Having lower costs will enable to become more competitive and have healthier margins.